As the DeepSeek AI story unfolds in the US stock market, investors are closely monitoring its impact on major indices including the Nasdaq composite, S&P 500 (SPX), and Dow Jones index. The Chinese AI company’s achievement in developing an AI model at just $5.58 million – roughly ten times less than Meta’s investment – has sparked intense discussion about the future of artificial intelligence and its market implications.

Revolutionary Cost Efficiency

DeepSeek, founded by Liang Wenfeng in 2023, has introduced its DeepSeek R1 AI model using just 2,000 Nvidia H800 GPUs over a 55-day training period. This achievement in Chinese AI technology, particularly in large language model (LLM) development, has captured attention in both Asian and US markets, demonstrating remarkable efficiency compared to Western competitors using up to 16,000 GPUs.

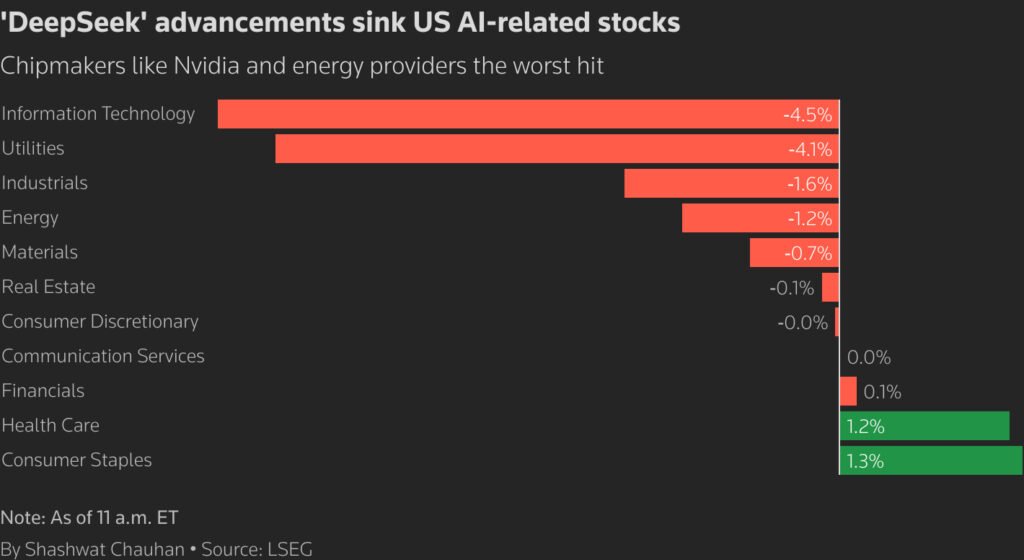

Market Impact and Stock Volatility

The stock market response has been dramatic, with approximately $593 billion wiped from AI and computer hardware companies’ market capitalizations. Nvidia’s stock price (NVDA) has faced a sharp decline of 17-18%, with investors closely tracking Nvidia premarket movements. The ripple effects have impacted the broader market, contributing to a total loss of $1 trillion in American stocks by January 28, affecting the Nasdaq today and overall US market sentiment.

Trading Activity and Market Response

Market participants are closely monitoring premarket indicators, including Dow futures, Nasdaq futures, and SP500 futures. The dramatic market response has prompted discussions about a potential stock market crash, with particular attention to Nvidia stock market crash concerns. Morgan Stanley and other financial institutions are actively analyzing these unprecedented movements in the US stock market.

Tech Sector Implications

Beyond Nvidia, other major tech stocks have been affected. Microsoft stock price movements reflect CEO Satya Nadella’s assessment of DeepSeek as “super impressive.” The development has drawn comparisons to a Sputnik moment in AI advancement, particularly regarding the US-China technological competition.

Global Market Perspective

Trading activity at the NYSE remains intense as investors digest DeepSeek news and its implications. The company’s ability to match GPT-4’s performance at a fraction of the cost has sparked extensive discussions about DeepSeek vs ChatGPT. Market analysts at the current New York time now are carefully monitoring these developments.

Looking Forward

As the market processes this technological advancement, attention focuses on upcoming NVDA earnings date and potential market reactions. The company’s efficient use of resources while achieving comparable performance to Western models has particularly interested investors in the AI stock sector.

Investment Implications

The emergence of DeepSeek in the AI landscape has created significant market movement, affecting everything from pre market trading to end-of-day results. Its success despite U.S. sanctions has led many to question why is the market down today and the broader implications for technological competition between major powers.