Strategy pushed forward with its ambitious Bitcoin accumulation plan, purchasing 7,633 BTC worth $742.4 million during early February 2025. The company executed these transactions between February 3rd and 9th at an average price of $97,255 per Bitcoin, reinforcing its position as a major institutional holder of the cryptocurrency.

Portfolio Growth and Investment Strategy

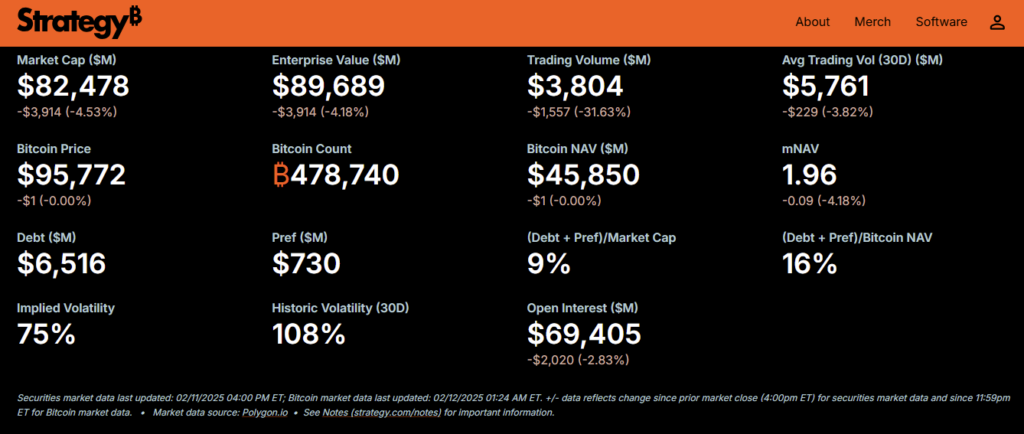

Strategy’s latest acquisition brings its total Bitcoin holdings to 478,740 BTC, accumulated at an average cost of $65,033 per Bitcoin. This substantial position reflects the company’s unwavering commitment to its Bitcoin-centered treasury strategy following its recent rebranding from MicroStrategy. The purchase demonstrates Strategy’s confidence in Bitcoin as a long-term store of value despite market fluctuations.

Financing and Future Plans

The company financed this significant Bitcoin purchase through a combination of stock sales and proceeds from a recently completed preferred stock offering. Strategy’s ambitious expansion plans include the “21/21 plan,” which aims to raise up to $21 billion in equity specifically for expanding its Bitcoin reserves. This aggressive funding approach underscores the company’s dedication to building one of the largest corporate Bitcoin treasuries globally.

Market Performance and Returns

Strategy’s Bitcoin investments have yielded impressive returns, with the company reporting a 74.3% Bitcoin yield for 2024. The early weeks of 2025 continued this positive trend, with Strategy achieving a 4.1% Bitcoin yield between January 1 and February 9. These strong performance metrics support the company’s ambitious target of generating $10 billion in gains during 2025.

Institutional Interest and Support

Major financial institutions have taken notice of Strategy’s Bitcoin-focused approach. BlackRock, already a significant Bitcoin holder through its spot ETF, has increased its stake in Strategy. This move signals growing institutional confidence in Strategy’s Bitcoin-centric business model and its potential for long-term value creation.

Corporate Evolution and Focus

Strategy’s recent name change from MicroStrategy represents more than just a rebranding exercise. The simplified name reflects the company’s streamlined focus on its Bitcoin strategy, marking a decisive shift in its corporate identity. This transformation emphasizes Strategy’s commitment to maintaining Bitcoin as a core element of its business model.

Market Impact and Trading Performance

The company’s Bitcoin acquisitions have significantly influenced its stock price movements, creating a strong correlation between Strategy’s market value and Bitcoin price fluctuations. This relationship highlights how Strategy has effectively positioned itself as a proxy for institutional Bitcoin exposure while maintaining the benefits of traditional equity market participation.

Future Outlook and Strategic Direction

Strategy‘s continued Bitcoin accumulation, coupled with its ambitious fundraising plans, positions the company for potential growth in the evolving cryptocurrency market. The “21/21 plan” demonstrates Strategy’s long-term commitment to Bitcoin while providing a clear roadmap for future expansion of its digital asset holdings.

The company’s successful track record in Bitcoin investment, combined with institutional support from major players like BlackRock, suggests Strategy’s Bitcoin-focused approach may continue to attract investor interest. As the cryptocurrency market matures, Strategy’s bold positioning could serve as a model for other corporations considering similar digital asset strategies.