Bitcoin price upside is primed to hit a minimum of $145,000 over the coming year as US pro-Bitcoin policy takes shape.

Fresh analysis suggests Bitcoin could surge to nearly $250,000 in 2025 as half a trillion dollars of new capital enters the market. A comprehensive report from onchain analytics platform CryptoQuant, released January 14, sets the stage for Bitcoin’s (BTC $99,462) next macro price peak.

$145,000 Becomes the Price Floor

Bitcoin appears positioned to reach at least $145,000 this year as the incoming US presidential administration catalyzes massive capital inflows, according to CryptoQuant’s latest research. The firm’s analysis highlights favorable US political and economic trends as fundamental drivers for their bullish thesis.

“About $520 billion of fresh capital could flow into Bitcoin in 2025,” researchers calculated. “In the context of favorable regulatory, monetary and cyclical conditions, it’s reasonable to expect capital to continue flowing into Bitcoin in 2025.”

Supporting data shows Bitcoin’s realized market cap – the aggregate value of supply as it moves onchain – since 2015. Following historical patterns, CryptoQuant suggests the $520 billion projection is achievable.

“Bitcoin could rise to $145k-$249k in 2025, given the expected capital inflows,” the report states. “The expansion in the total capital invested in Bitcoin (realized capitalization) has a more-than-proportional effect on Bitcoin’s market value and price.”

Million-Dollar Moonshot

CryptoQuant joins a growing chorus of bullish BTC price predictions for the coming year, including some targeting the $1 million threshold. Samson Mow, CEO of Bitcoin adoption firm JAN3, shared this ambitious view in a recent Cointelegraph interview, describing future “omega” BTC price movements.

“You’ll start to go up by 10,000 a day or drop by 10,000 a day. And this is the God candle. After that, we’ll start to see Omega candles, which are 100,000 increments daily,” Mow explained regarding future BTC/USD price action. He continues advocating for the $1 million target on social media.

Short-Term Outlook Remains Positive

Despite touching two-month lows this week, Bitcoin’s short-term prospects maintain optimistic momentum. As Donald Trump’s January 20 inauguration approaches, speculation builds around potential first-day announcements that could set the tone for the crypto bull market.

“Standard stuff…. my feeling is that BTC is currently a bit of a beach ball under water with the legacy markets sitting on it for now,” Filbfilb, DecenTrader’s co-founder, shared with Telegram subscribers regarding recent price action. He suggests that bearish sentiment across risk assets, driven by Fed policy concerns, may temporarily suppress crypto market performance.

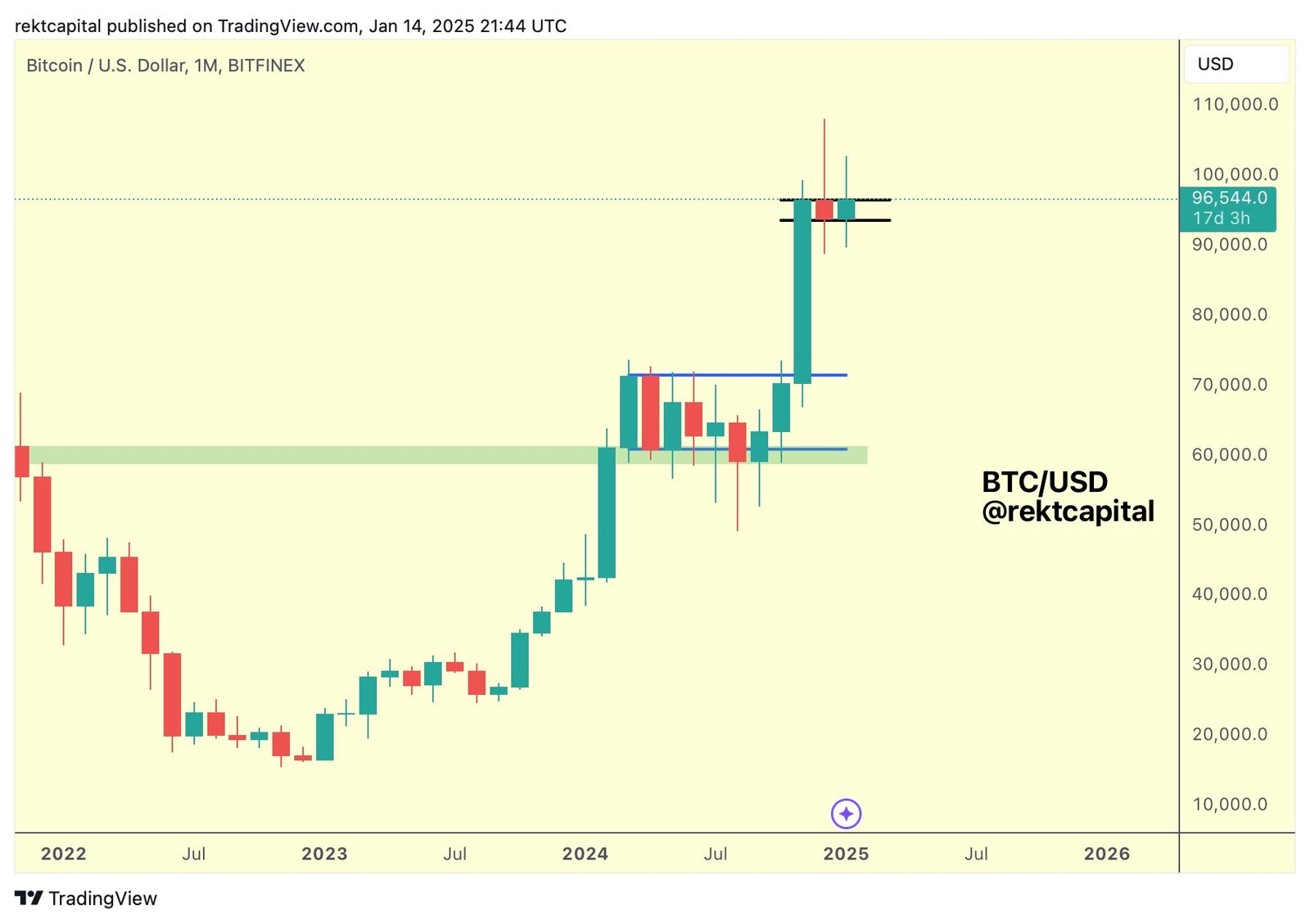

Trading analyst Rekt Capital notes that “a case can still be made for a Monthly Bull Flag.” On daily timeframes, he describes BTC/USD as transitioning “from threatening a downside deviation To strongly rebounding and developing a new Higher Low.”

“Lots can change within 24 hours for Bitcoin,” he concluded.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.